Financing sustainable growth in Aotearoa New Zealand.

The New Zealand Government has an ambitious economic growth agenda that aims to unlock New Zealand’s potential, grow the economy and ease the cost of living for New Zealanders. The Government’s growth aspirations are set in the context of unprecedented change – including a rapidly warming climate, ageing populations, increased geopolitical and trade tensions, and technology change. The speed and scale of these changes have the potential to destabilise economies, strain public resources, disrupt labour markets, and increase vulnerability to global conflicts.

Making capital flow to the right places to respond to these goals and challenges is difficult. This is partly due to a short-term focus, as well as a lack of tools to effectively assess trade-offs and accurately price social and environmental risks. To achieve the Government’s desired outcomes from growth, we need clear and cohesive government policies and regulation that can effectively attract, mobilise and direct both public and private capital.

Within a rapidly evolving international landscape, where global sovereigns are deploying sustainable finance strategies which create a cohesive and coordinated plan for attracting and directing investment, there are real and opportunity costs to New Zealand from delayed action or inaction.

Responding to a request from the Minister of Climate Change, in February 2025 CSF made recommendations to the New Zealand government for a national sustainable finance strategy. These recommendations were developed through engagement across the public and private sectors.

The recommended vision of the strategy is ‘finance that unlocks New Zealand’s potential and enables the growth, innovation and capital required for current and future generations to thrive’.

Our inputs on the finance strategy are currently under consideration by the Minister of Climate Change.

The ‘Starter for Ten’ guide is a straightforward approach to sustainability metrics specifically designed for New Zealand’s SMEs. It is aligned with both local standards and international best practice.

Businesses that understand their performance on these metrics will better understand risks to their business and opportunities to respond to customer and lender expectations.

We developed the ‘Starter for Ten’ guide in collaboration with KPMG New Zealand and with input from New Zealand’s major banks and financial institutions. Learn more in our media release, here.

*By subscribing to this list, you agree to receive updates from the Centre for Sustainable Finance on the Starter for Ten Guide related projects and relevant events.

Enter your name and email address to subscribe.

Read more about the Centre for Sustainable Finance.

Grounded in the Sustainable Finance Form’s 2030 Roadmap for Action.

Learn more about our Board and Executive Team.

Our work would not be possible without the support of our partners.

Financing sustainable growth in Aotearoa New Zealand.

A classification system for sustainable economic activities.

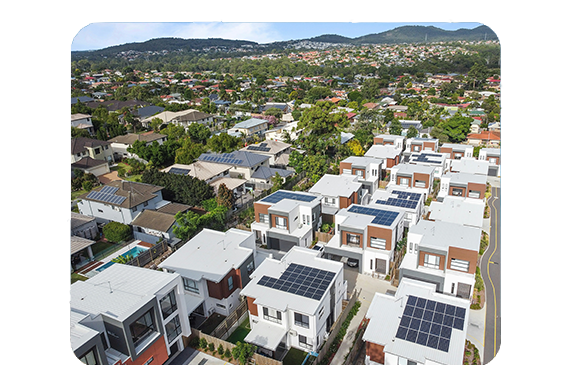

Accelerating financing solutions for affordable, abundant clean energy.

Guidance for SMEs to start sustainability reporting.

Promoting greater options for New Zealand investors