New Zealand faces tightening energy supply – driven by depleted gas reserves – putting real pressure on households and businesses. As fuel constraints, along with infrastructure costs, push electricity and gas prices higher, businesses – particularly those that are energy-intensive – face rising operating costs, reduced global competitiveness and increased risk of closure.

Families may experience greater energy hardship — struggling to afford heating, hot water, and everyday power needs.

Uncertainty around future energy availability and price also discourages investment and long-term planning, amplifying inequities as only the most resilient or well-resourced households and firms can absorb the shocks.

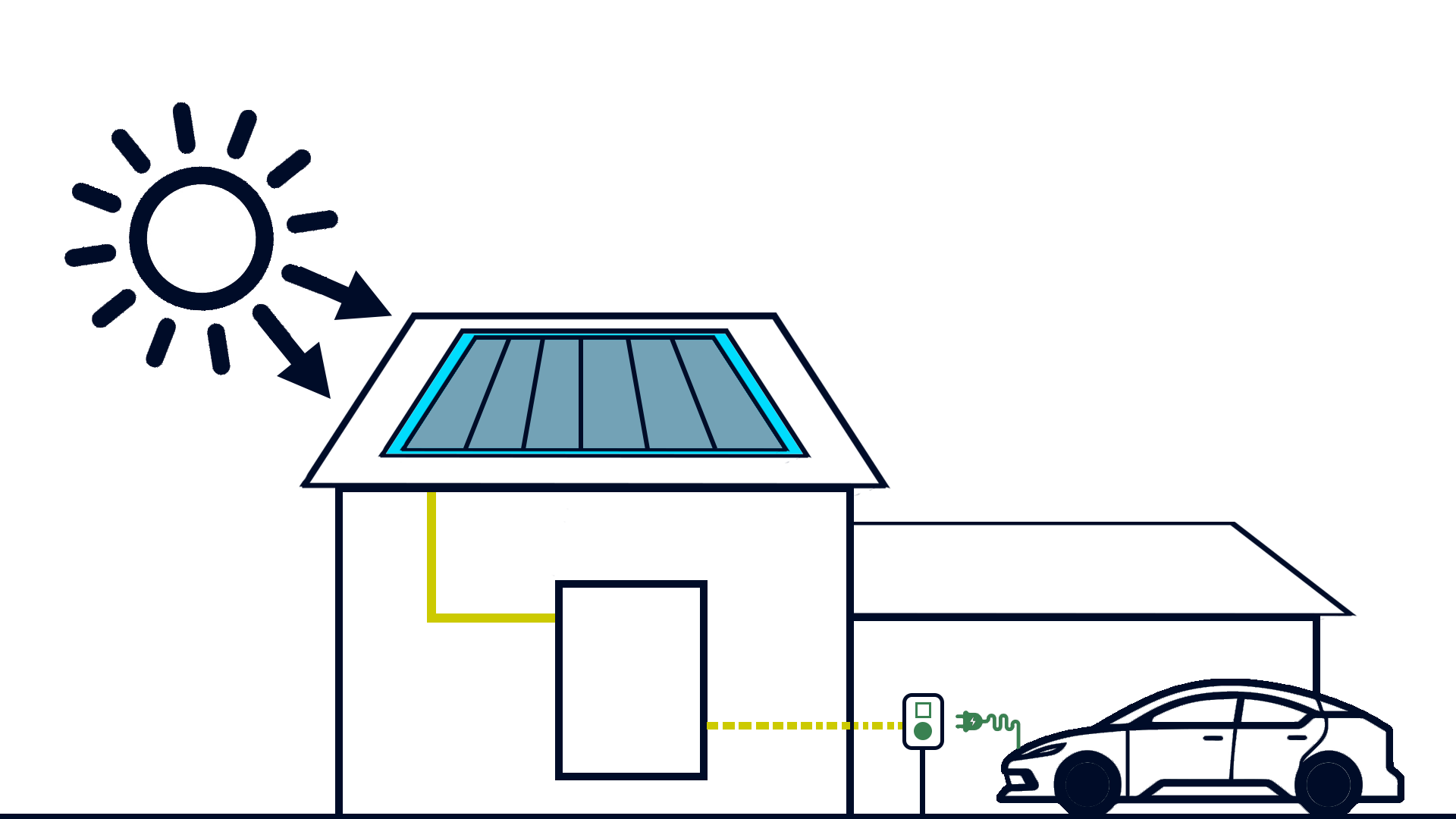

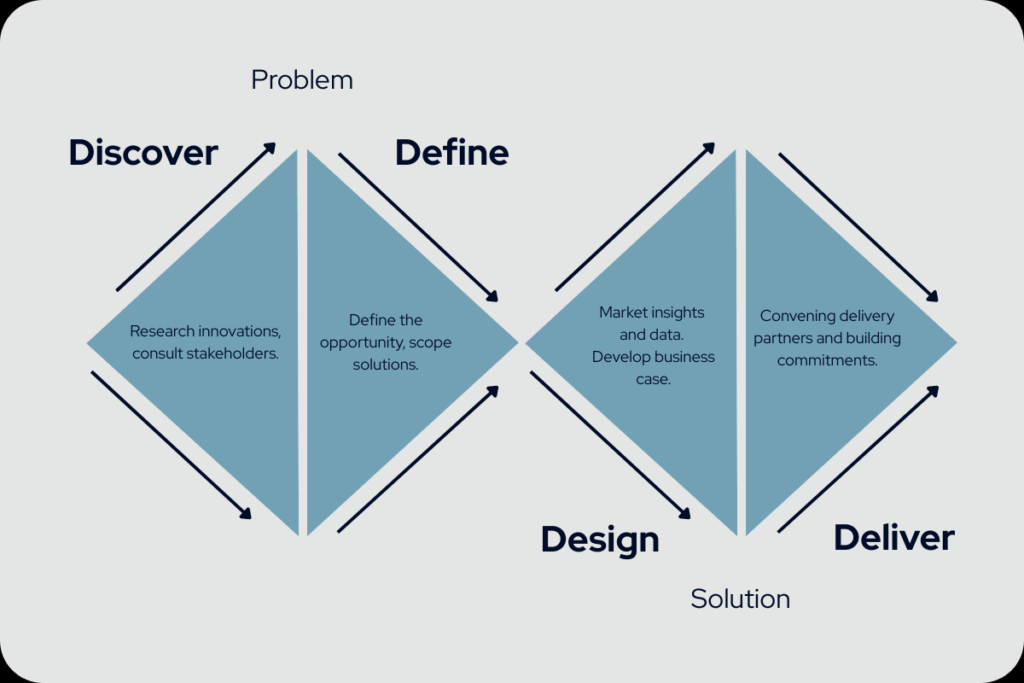

A significant opportunity for strengthening New Zealand’s energy system and resilience lies in transitioning to new energy technology, but many businesses and households struggle to understand which choices to make, and how to pay for them. Making financing easier, faster and simpler will accelerate the transition for households and businesses from fossil fuels to abundant, reliable, affordable energy.